What Is the Cyprus Margin Scheme?

The Cyprus Margin Scheme simplifies VAT calculations for businesses selling second-hand goods. Instead of paying VAT on the full selling price, businesses only pay on the margin—the difference between purchase and selling prices. This approach benefits retailers and e-commerce businesses dealing with used items like cars, electronics, and collectibles.

Consider selling a used car. If you buy it for €5,000 and sell it for €6,000, you pay VAT only on the €1,000 margin. This reduces the VAT burden, making second-hand goods more affordable for customers and profitable for businesses.

In this article, we'll explain the Cyprus Margin Scheme in detail. We'll cover who can use it, how to calculate VAT under the scheme, and what you need to do to stay compliant. Whether you're new to this concept or want to improve your current practices, this guide will help you understand the Cyprus Margin Scheme better. Let's begin!

Margin Scheme Calculator

Calculate your profit and the VAT you have to pay in a click

Eligibility for the Margin Scheme

The Cyprus Margin Scheme isn't for everyone. It's specifically for businesses dealing in certain types of goods and services. Here's what you need to know about eligibility:

- Types of Goods: The scheme applies to second-hand goods, works of art, antiques, and collector's items. These categories are pretty clear-cut, so make sure your items fit the bill.

- Second-Hand Vehicles: For second-hand vehicles, there are a few more hoops to jump through. The vehicle must be acquired without VAT charged. This usually means buying from private individuals or businesses that didn't charge VAT initially.

- Acquisition Conditions: You need to buy goods without VAT charged. This could be from private sellers, or businesses that used the Margin Scheme themselves. Detailed records are crucial here. Keep track of the purchase price, selling price, and ensure no VAT was initially charged.

- Travel Services (TOMS): For travel agents using the Tour Operators Margin Scheme (TOMS), the services must be bought and resold as a travel package. VAT is calculated on the margin, and the place of supply is where the travel agent is established.

If you're dealing with second-hand goods or specific services like travel packages, and meet these criteria, you can benefit from the Margin Scheme. This helps reduce the VAT burden and makes your offerings more attractive. To fully understand the obligations and nuances of VAT reporting, you might find it useful to read more about the Cyprus VAT Return procedures, which detail quarterly submission requirements and deductible expenses.

Types of Goods and Services Covered

The Cyprus Margin Scheme covers a variety of goods and services, each with specific criteria. Here's a breakdown:

- Second-Hand Goods: This includes items like used electronics, furniture, and clothing. The key is that these goods must have been purchased without VAT, often from private sellers.

- Works of Art and Antiques: Items classified as works of art or antiques can also be sold under the Margin Scheme. These need to meet certain age and originality criteria to qualify.

- Collector's Items: This category includes rare items like stamps, coins, and memorabilia. As with other goods, these must be acquired without VAT.

Second-hand vehicles have additional specifics:

- Second-Hand Vehicles: For vehicles, they must be bought without VAT, typically meaning a purchase from private individuals. Detailed records of the purchase price and selling price are essential.

Travel services are covered under the Tour Operators Margin Scheme (TOMS):

- Accommodation Services: If you're reselling hotel stays or other lodging, the Margin Scheme applies to the margin between what you paid and what you charge your customers.

- Transport Services: This includes reselling flights, bus tours, and other travel. Like accommodation, VAT is calculated on the margin.

- Tour Packages: When combining travel, accommodation, and activities into a package, TOMS applies. The margin is the difference between the total amount received and the actual costs for the services provided.

Understanding these categories helps ensure your business can benefit fully from the Cyprus Margin Scheme. For businesses navigating the complex tax landscape in Cyprus, it's also crucial to stay updated with the Cyprus Tax Calendar, which outlines essential monthly compliance deadlines for various tax obligations.

Supplier Obligations Under the Margin Scheme

Using the Cyprus Margin Scheme means you've got some responsibilities to keep things running smoothly. Here's what you need to know:

- Calculate VAT on the Margin: For both SHMS and TOMS, VAT is only on the margin between the purchase and selling prices. Forget full price VAT payments; it’s just the margin that matters.

- Detailed Record-Keeping: Keep track of every transaction. You need records of purchase price, selling price, and margin for each item. This isn't optional—it's essential for compliance.

- Invoicing Requirements: Your invoices should mention that the VAT is calculated under the Margin Scheme. This keeps everything transparent and above board for your customers and the tax authorities.

For second-hand vehicle suppliers, the rules get a bit more specific:

- Determine Selling Price and Purchase Price: Document the purchase price when you buy the vehicle and the selling price when you sell it. The margin is the difference between these two.

- Margin Calculation: VAT is calculated on this margin. If you buy a car for €4,000 and sell it for €5,000, VAT is only on the €1,000 difference.

- Proper Documentation: Detailed records must be kept for each vehicle. This includes the margin calculation, purchase receipts, and sales invoices. Make sure everything is documented properly to avoid any legal hiccups.

Meeting these obligations ensures you stay compliant and can fully benefit from the Cyprus Margin Scheme. For further understanding of tax obligations and benefits in Cyprus, you might want to explore the corporate income tax framework in Cyprus, which delves into the standard tax rates, exemptions, and other regulations that could impact your business operations.

Buyer Responsibilities Under the Margin Scheme

Using the Cyprus Margin Scheme isn't just about the sellers. Buyers have their own set of responsibilities to keep everything legit and compliant.

First off, VAT registration is key. If you're buying second-hand goods under the Margin Scheme, you need to be VAT-registered in the country where the purchase is made. This ensures that all transactions are properly recorded and reported.

- VAT Registration: Make sure you're registered for VAT in the country of purchase. This is essential for compliance and proper record-keeping.

Next, let's talk about the place of supply rules for TOMS (Tour Operators Margin Scheme). If you're buying travel services to resell, the place of supply is where you're established. This affects how and where VAT is calculated and paid.

- Place of Supply Rules: For travel services under TOMS, VAT is calculated where your business is established. This means your location determines how VAT is applied.

Record-keeping is another big responsibility, especially if you're buying second-hand vehicles. You need to keep detailed records of each transaction, including the purchase price, selling price, and the margin. This isn't just good practice; it's a legal requirement.

- Detailed Records: Keep track of purchase price, selling price, and margin for each second-hand vehicle. This includes invoices and receipts.

- Compliance Documentation: Ensure all documents are properly stored and easily accessible for audits. This includes VAT invoices, purchase receipts, and any other relevant paperwork.

Staying on top of these responsibilities ensures you remain compliant and can fully benefit from the Margin Scheme. Proper documentation and VAT registration make the process smoother and keep you in the clear with tax authorities.

Calculating VAT for the Margin Scheme

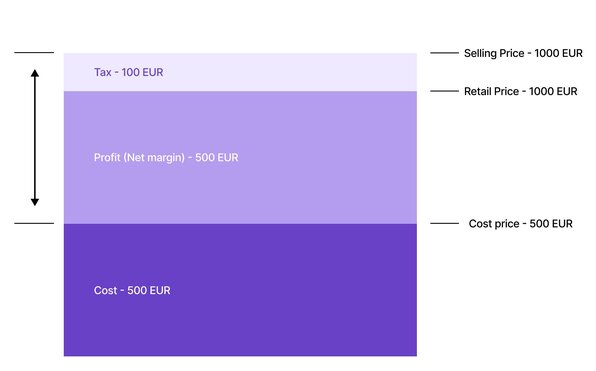

Calculating VAT under the Cyprus Margin Scheme might seem tricky at first, but it’s actually pretty straightforward once you get the hang of it. Let’s break it down with some examples.

Second-Hand Goods (SHMS):

- Purchase Price: €400

- Selling Price: €1,000

- Margin: €1,000 - €400 = €600

- VAT Calculation: If the VAT rate is 19%, you only apply it to the €600 margin. VAT on the margin is €600 * 19/100 = €95,80.

Step-by-Step:

- Determine the purchase price of the second-hand good.

- Determine the selling price.

- Calculate the margin by subtracting the purchase price from the selling price.

- Apply the VAT rate to the margin.

Tour Operators Margin Scheme (TOMS):

- Total Amount Paid by Traveler: €3,000 (excluding VAT)

- Actual Costs for Goods and Services: €2,500

- Margin: €3,000 - €2,500 = €500

- VAT Calculation: If the VAT rate is 19%, VAT is applied to the €500 margin. VAT on the margin is €500 * 19/100 = €95.

Step-by-Step:

- Calculate the total amount paid by the traveler, excluding VAT.

- Calculate the actual costs for goods and services purchased from other suppliers.

- Find the margin by subtracting the actual costs from the total amount paid by the traveler.

- Apply the VAT rate to the margin.

Second-Hand Vehicles:

- Purchase Price: €4,000

- Selling Price: €5,000

- Margin: €5,000 - €4,000 = €1,000

- VAT Calculation: For a 19% VAT rate, VAT on the margin is €1,000 * 19/100 = €190.

Step-by-Step:

- Note the purchase price of the vehicle.

- Note the selling price.

- Calculate the margin by subtracting the purchase price from the selling price.

- Apply the VAT rate to the margin.

Margin Scheme Calculator

Calculate your profit and the VAT you have to pay in a click

VAT on Importation and Sales to Other Countries

Handling VAT for importation and cross-border sales can get tricky under the Cyprus Margin Scheme. Let's break it down so you can stay compliant and avoid surprises.

Importing Second-Hand Goods: When importing second-hand goods into Cyprus, VAT is generally due upon importation. This means that even if you plan to sell these goods under the Margin Scheme, you’ll still need to pay VAT when they enter the country. The Margin Scheme doesn’t apply to imported second-hand vehicles; these must follow normal VAT rules.

Sales to Other EU Countries: If you’re selling second-hand goods to another EU country, the place of supply rules come into play. For SHMS, VAT is charged based on where the sale occurs. This means you’ll need to be aware of the VAT rules in the buyer's country. For TOMS, VAT is calculated where your business is established, making it simpler to manage.

Foreign Currency Transactions: Selling second-hand vehicles or goods in foreign currency? You’ll need to convert the transaction into euros for VAT calculations. Use the exchange rate on the invoice date to ensure accuracy. Keep detailed records of these conversions to avoid any compliance issues.

For more detailed insights into tax advantages that can benefit your business, explore our comprehensive guide on Cyprus tax advantages for residents.

Here's a quick rundown:

- VAT on Importation: Due on import of second-hand goods. Margin Scheme not applicable for imported vehicles.

- Place of Supply Rules: For SHMS, VAT based on sale location. For TOMS, VAT where your business is established.

- Foreign Currency: Convert transactions to euros using the invoice date exchange rate.

Understanding these nuances helps you manage VAT effectively for cross-border transactions under the Cyprus Margin Scheme.

Special Cases and Bulk Purchases

Bulk purchases and special cases under the Cyprus Margin Scheme can get a bit tricky, but let's break them down.

Bulk Purchases

When buying in bulk, the purchase price must be apportioned. If you buy a lot of second-hand goods, you need to divide the total purchase price among the individual items. That way, the margin on each item is clear when you sell them.

- Apportioning Purchase Price: If you buy 10 used laptops for €2,000, each laptop's purchase price is €200. When you sell one for €300, the margin is €100, and VAT is only on that €100.

- Detailed Records: Keep a record of each item's allocated purchase price. This ensures accurate margin calculations and compliance with VAT rules.

Special Cases for TOMS

For travel services under TOMS, special cases like B2B transactions have unique considerations.

- B2B Customers: When selling travel packages to other businesses, the place of supply still affects VAT. If you're established in Cyprus, you calculate VAT based on your location, even for B2B deals.

Second-Hand Vehicles from Insurance Companies or Finance Houses

Second-hand vehicles bought from insurance companies or finance houses have specific rules.

- Insurance Companies: Vehicles bought from insurance companies are often sold under the Margin Scheme if the original purchase didn't include VAT. Keep detailed records of these transactions to ensure compliance.

- Finance Houses: If you're buying from a finance house, check if VAT was applied to the original sale. If not, you can use the Margin Scheme. Detailed documentation is essential here too.

Understanding these special cases and handling bulk purchases correctly ensures you stay compliant and make the most of the Cyprus Margin Scheme. For more detailed insights into managing your accounting processes efficiently, explore how Cybooks' accounting software tailored for the Cypriot market can simplify your bookkeeping and financial management tasks.

Input VAT Deduction Rules

Understanding the rules for input VAT deductions under the Cyprus Margin Scheme is crucial to stay compliant and optimize your business operations. Here's a quick rundown:

No VAT Charged on SHMS

For second-hand goods under SHMS, VAT is not charged under the VAT Act. Instead, VAT is applied only to the profit margin. This means:

- No Input VAT Deduction: You can't deduct VAT on the purchase of goods acquired under the Margin Scheme.

- VAT on Margin: VAT is calculated solely on the profit margin—the difference between the purchase price and selling price.

TOMS and Input VAT

Tour Operators Margin Scheme (TOMS) has its own set of rules:

- Non-Deductible Input VAT: VAT on contracted supplies (like hotel rooms or transport services) can't be deducted. However, you can still deduct VAT on other business expenses not related to the travel services.

- Focus on Margin: VAT is calculated on the margin, which is the difference between the total selling price and the cost of supplies.

Second-Hand Vehicles

Handling second-hand vehicles requires careful attention:

- Insurance Products: If you sell second-hand vehicles with insurance products, these must be accounted for separately. VAT on the margin still applies, but the insurance part might have different VAT implications.

- Warranties: Similar to insurance, warranties sold with vehicles need proper documentation. These can affect the margin calculation, so keep detailed records.

Key Points

- Detailed Records: Always maintain detailed records of purchase prices, selling prices, and margins. This ensures accurate VAT calculations and compliance.

- Proper Documentation: For both SHMS and TOMS, proper documentation is essential. This includes invoices, receipts, and any contracts related to the sale or purchase.

For more insights on leveraging tax benefits in Cyprus, consider reading our comprehensive guide on enhancing tax savings through non-domiciled status. This guide can help you understand how Cyprus's favorable tax environment can benefit your business.

Understanding these rules helps you navigate the complexities of VAT under the Cyprus Margin Scheme, making your business more efficient and compliant.

Record-Keeping Requirements

Keeping accurate records is crucial when using the Cyprus Margin Scheme. It ensures compliance and makes audits a breeze. Here’s what you need to know.

Corrective VIES Statements for SHMS

For second-hand goods under SHMS, detailed record-keeping is a must. You need to keep:

- Invoices: Clearly show that goods were taxed under the Margin Scheme.

- Stock Book: Maintain a stock book with purchase and sales details, stock numbers, and margin calculations.

Corrective VIES statements are important. These statements correct any discrepancies in your VAT reporting, ensuring accuracy and compliance.

Emphasis on Compliance for TOMS

Travel agents using TOMS also have specific record-keeping requirements:

- Invoices and Contracts: Keep all invoices and contracts for services purchased and resold.

- Detailed Documentation: Document the costs of services purchased and prices charged to customers.

Compliance is key. Proper documentation helps avoid issues with tax authorities.

Second-Hand Vehicles

When dealing with second-hand vehicles, your records need to be spot-on:

- Purchase and Sales Details: Record the purchase and selling prices for each vehicle.

- Stock Numbers: Assign and track stock numbers for each vehicle.

- Margin Calculations: Keep detailed calculations of the margin for each sale.

Maintaining these records ensures you meet all legal requirements and can benefit fully from the Margin Scheme.

By keeping thorough and accurate records, you’ll stay compliant and make managing your VAT obligations much easier. For more detailed guidance on tax compliance and other accounting best practices, visit our Cybooks Tax Blog.

Practical Scenarios

Understanding how the Cyprus Margin Scheme works in real-world situations can make a big difference. Let's look at some practical scenarios to see how it applies.

- Buying from Other EU Countries: You're a retailer in Cyprus buying used electronics from Germany. To use the Margin Scheme, buy the goods without VAT. When you sell these items in Cyprus, you only pay VAT on your profit—the difference between what you paid and what you sold it for. Keep good records of all your buys and sells to stay compliant.

- Booking a Holiday Package (TOMS): You're a travel agent using TOMS. You book a holiday package for €2,000 and sell it for €2,500. You pay VAT on the €500 profit. Make sure your invoices and contracts clearly show what you paid for services and what you charged your customers.

- Handling Auctions or Online Purchases for Used Cars: You buy a used car at an auction for €3,000 and sell it for €4,000. You only pay VAT on the €1,000 profit. Write down the purchase price, selling price, and how you calculated your profit. This helps you stay compliant and avoid problems with tax authorities.

These examples show how the Cyprus Margin Scheme works in everyday business. Whether you're selling used goods, travel services, or cars, knowing and following the scheme's rules helps you manage your VAT duties effectively. For a comprehensive digital solution that can help you manage these tasks, consider exploring our accounting software designed specifically for small businesses in Cyprus. This tool can streamline your bookkeeping and financial management, making VAT compliance easier.

Key Takeaways

Understanding the Cyprus Margin Scheme for second-hand goods is essential for businesses looking to minimize their VAT liabilities. Here’s what you need to remember:

- Eligibility: The scheme is for businesses dealing in second-hand goods, works of art, antiques, and collector's items. For second-hand vehicles, purchases must be made without VAT charged, typically from private sellers or businesses using the scheme.

- Calculation: VAT is only applied to the margin—the difference between the purchase and selling prices. For travel services under TOMS, the margin is the difference between the total amount received and the actual costs for the services.

- Compliance: Keeping detailed records is crucial. You need to track purchase prices, selling prices, and margins for each transaction. Proper invoicing and documentation are essential to stay compliant.

- Importation and Cross-Border Sales: VAT is generally due upon importation of goods into Cyprus. For cross-border sales within the EU, VAT rules depend on the location of the sale and the type of goods or services.

- Special Cases: Bulk purchases require apportioning the purchase price among individual items. For TOMS, B2B transactions must consider the place of supply rules. Vehicles from insurance companies or finance houses have specific considerations.

- Input VAT Deductions: Under SHMS, you can't deduct VAT on purchases; VAT is only on the margin. For TOMS, input VAT on contracted supplies can't be deducted, but other business expenses might be eligible.

Understanding and applying the Cyprus Margin Scheme correctly can significantly benefit your business, reducing VAT liabilities and simplifying tax compliance. Keep these points in mind to make the most of the scheme.