If you're a business owner in Cyprus, understanding how VAT (Value Added Tax) works is essential. VAT is a tax on goods and services that affects both your business and your customers. In this article, we’ll cover the basics of VAT in Cyprus, the different VAT rates, how to reclaim VAT, and who is eligible to do so.

VAT Rates in Cyprus

Cyprus has different VAT rates based on the type of goods or services. The main rates are:

- Standard Rate (19%): This is the most common VAT rate applied to most goods and services in Cyprus.

- Reduced Rates (9% and 5%): Some goods and services benefit from reduced VAT rates. For example, a 9% rate applies to hotel accommodation, restaurants, and transport services. The 5% rate applies to essentials like food, pharmaceuticals, books, and some health services.

- Zero Rate (0%): A zero rate is applied to exports and certain transactions, meaning VAT is charged at 0% but allows the seller to reclaim input VAT.

- Exemptions: There are also VAT-exempt services such as medical services, education, and rental of residential property, where no VAT is charged, and input VAT cannot be reclaimed.

Registering for VAT in Cyprus

Businesses must register for VAT if their annual turnover exceeds the threshold of €15,600. Voluntary registration might be beneficial for businesses below this threshold, as it allows them to reclaim VAT on expenses and potentially improve cash flow. If your turnover is below this amount, you may still register voluntarily, which may be beneficial if you incur VAT on expenses and want to claim it back.

Registration can be done online through the Tax Department Portal or by completing the appropriate VAT registration form and submitting it to your local Tax Department office.

In our Cyprus Business Guide, we're showing on how to obtain a tax identification code.

Reclaiming VAT in Cyprus

One of the advantages of being VAT registered is the ability to reclaim VAT paid on business expenses. Here’s how the process works:

- Input VAT: Businesses can reclaim the VAT paid on goods and services purchased for business purposes. This is known as input VAT. The amount of VAT you can reclaim will depend on whether the purchases are for taxable business activities.

- VAT Returns: To reclaim VAT, you need to complete and submit regular VAT returns to the Tax Department. In Cyprus, VAT returns are usually filed on a quarterly basis, and they must be submitted no later than the 10th day of the second month following the end of the quarter. For example, the VAT return for Q1 (January - March) must be submitted by May 10th.

- Refunds: If your input VAT exceeds your output VAT (i.e., VAT collected from customers), you will be eligible for a VAT refund. These refunds can help improve your business's cash flow by providing additional liquidity that can be used for day-to-day operations or reinvestment. Refunds are typically processed within four months of filing the VAT return, provided that all documentation is accurate and complete.

When to Pay VAT

Businesses are required to pay any VAT due when they submit their VAT returns. The payment must be made by the deadline for filing the return, which is usually the 10th day of the second month following the end of the quarter. For example, VAT for Q1 (January - March) must be paid by May 10th. Late payments may incur penalties and interest, so it is important to ensure that VAT is paid on time.

When Can You Reclaim VAT?

You can reclaim VAT when submitting your VAT return. If your input VAT (the VAT you have paid on business expenses) is greater than your output VAT (the VAT you have collected from customers), you can claim a refund for the difference. VAT can only be reclaimed if it relates to taxable business activities, and you must keep accurate records and receipts to support your claim. Refunds are typically processed within four months of submitting the return, provided all information is correct.

The Cybooks's tax calendar shows you a full overview about all tax deadlines and when they're due.

Understanding the VAT Return Boxes in Cyprus

Filing a VAT return can be challenging, especially when you are trying to figure out how to fill in all the different boxes on the VAT return form. In Cyprus, the VAT return form is designed to capture all relevant VAT-related transactions, ensuring that businesses report their VAT liabilities accurately. In this article, we will go through each of the VAT boxes to help you understand what information to include in each section.

Box 1: Value of Taxable Supplies at Standard Rate

In Box 1, you need to enter the total value of all taxable supplies at the standard VAT rate of 19%. This includes the value of goods and services sold in Cyprus that are subject to the standard VAT rate. This value should not include any VAT charged on these supplies.

Box 2: Output Tax at Standard Rate

Box 2 is used to enter the amount of output VAT that you have charged on the supplies reported in Box 1. Output VAT is the VAT you charge your customers when they purchase your goods or services.

Box 3: Value of Taxable Supplies at Reduced Rates

In Box 3, you must enter the total value of taxable supplies that are subject to the reduced VAT rates of 9% or 5%. This could include services such as hotel accommodations (9%) or goods such as food and pharmaceuticals (5%). As with Box 1, this value should exclude any VAT charged.

Box 4: Output Tax at Reduced Rates

Box 4 is for the output VAT that you have charged on supplies at the reduced VAT rates. You should report the VAT charged at either the 9% or 5% rates here. This VAT is collected from your customers and should be reported separately from the standard rate.

Box 5: Value of Zero-Rated Supplies

In Box 5, you need to enter the value of any supplies that are zero-rated. Zero-rated supplies include exports and certain intra-community supplies where the VAT rate is 0%, but the transaction still needs to be recorded.

Box 6: Exempt Supplies

Box 6 is used to report the value of VAT-exempt supplies. These are goods or services that are not subject to VAT, such as medical services, education, or residential property rental. Note that no VAT is charged on these supplies, and they are not included in your VAT calculations.

Box 7: Value of Imports and Acquisitions

In Box 7, enter the value of imports and intra-community acquisitions of goods from other EU countries. This is the total value before any VAT is added.

Box 8: Input Tax Deducted

Box 8 is for reporting the input VAT that you are reclaiming. This is the VAT that you have paid on goods and services purchased for business purposes. Only include input VAT that is allowable and directly related to taxable business activities.

Box 9: Net VAT Payable or Refundable

In Box 9, you will calculate the net VAT. This is the difference between your output VAT (Boxes 2 and 4) and your input VAT (Box 8). If your output VAT exceeds your input VAT, this box will show the VAT amount you need to pay to the Tax Department. If your input VAT exceeds your output VAT, this will indicate the amount you can claim as a refund.

Box 10: Adjustments

Box 10 is used for any adjustments that need to be made to the VAT return. Adjustments could include corrections from previous returns, adjustments for bad debts, or other VAT-related corrections that need to be accounted for in the current return.

Box 11: Total VAT Due

In Box 11, enter the total amount of VAT payable for the period, taking into account any adjustments. This is the final amount that needs to be settled with the Tax Department.

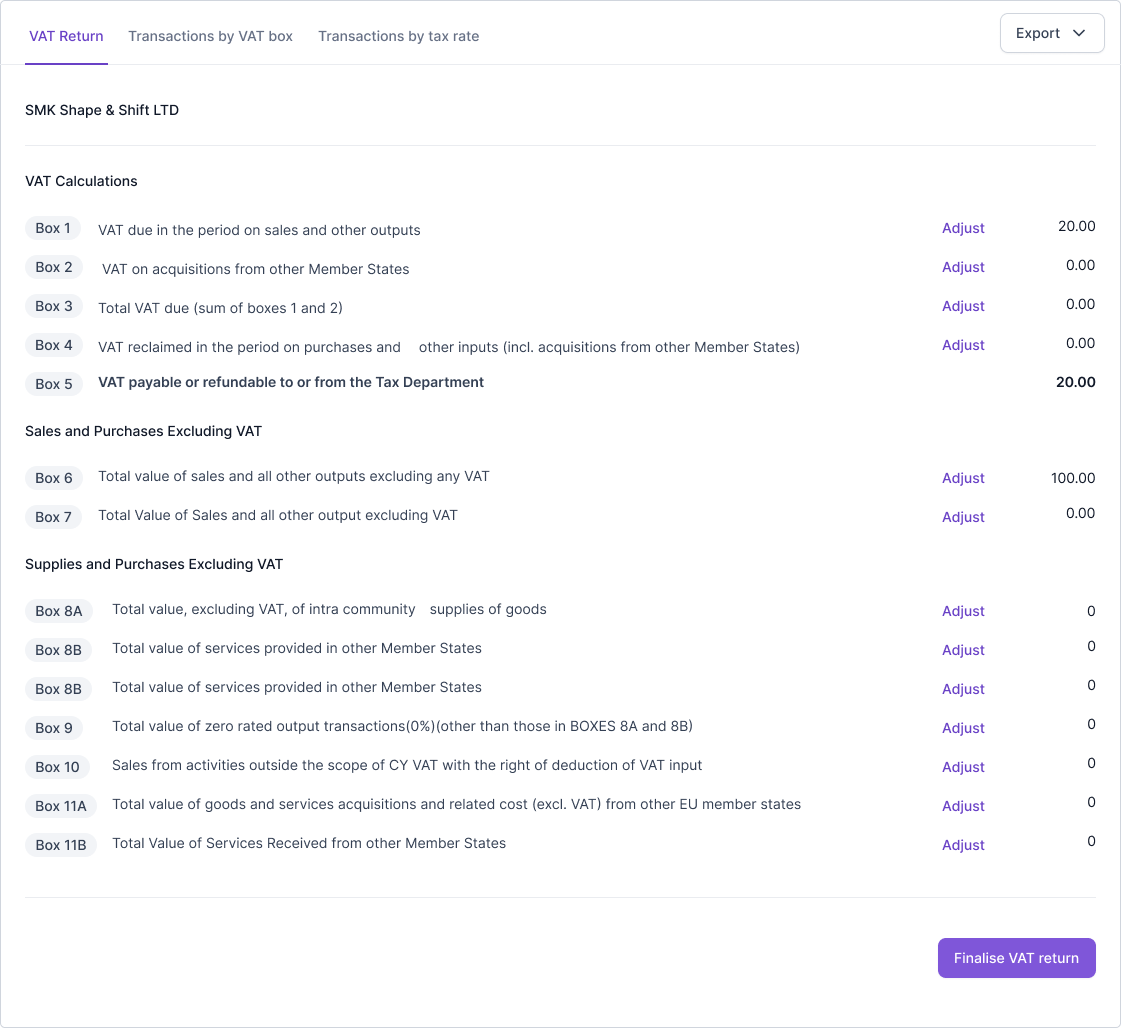

Cybooks does calculate and prepare all the VAT boxes for you based on your transactions. Each box for the VAT return is automaticlly calculated based on your transactions recorded within Cybooks.

Submitting VAT Returns

VAT returns in Cyprus must be submitted quarterly. The deadlines for submission are as follows:

- Q1 (January - March): Return must be submitted by May 10th.

- Q2 (April - June): Return must be submitted by August 10th.

- Q3 (July - September): Return must be submitted by November 10th.

- Q4 (October - December): Return must be submitted by February 10th of the following year.

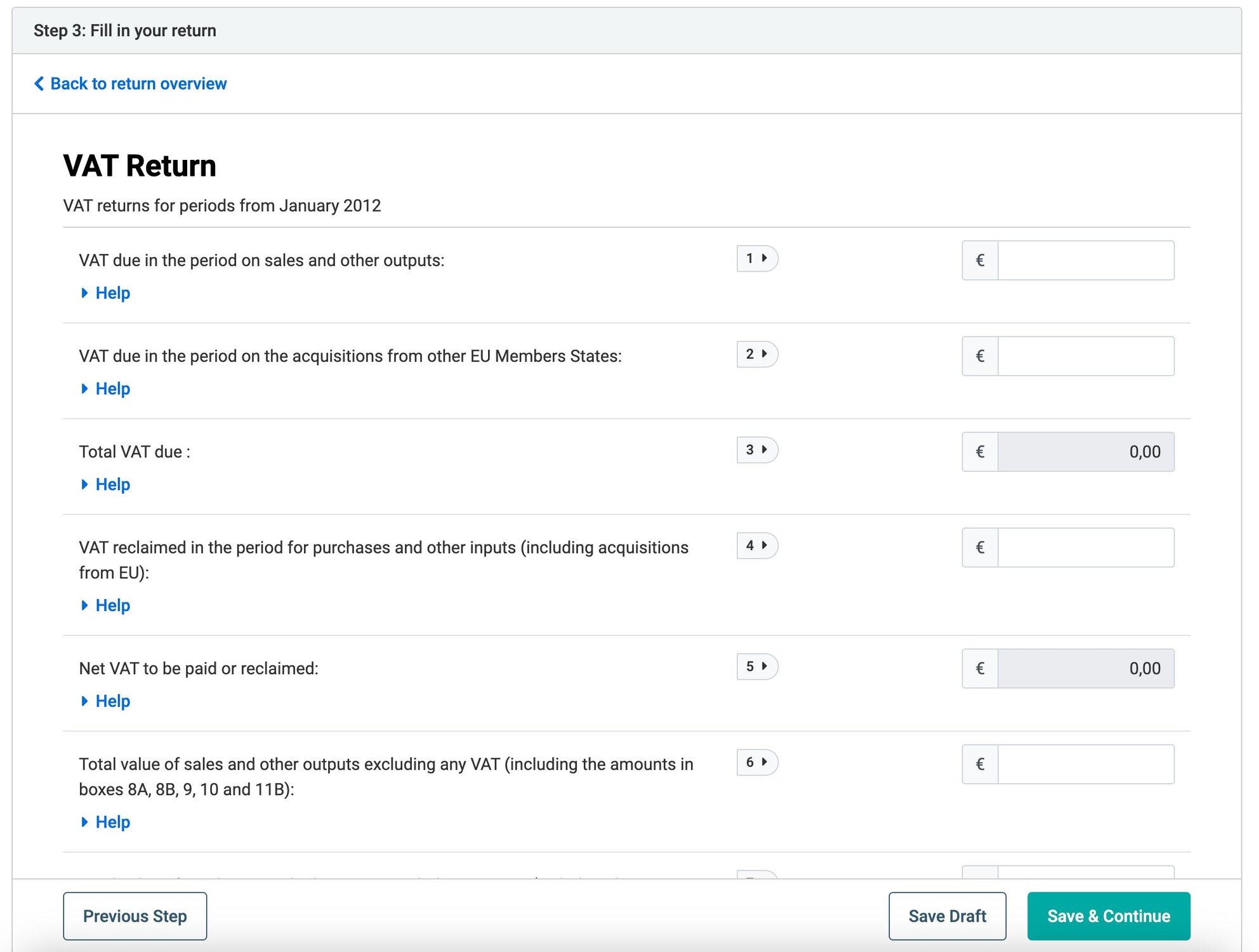

Returns can be submitted electronically through the Tax for All Portal. To do so, you need to log in using your credentials, fill in the required information regarding your VAT transactions, and submit the form. Electronic submission is the most efficient method and ensures timely processing of your returns and potential refunds.

Where and How to Submit VAT Returns

VAT returns must be submitted to the Cyprus Tax Department. The most common method is through the Tax for All Portal (TFA), which allows for electronic submission. This portal provides a user-friendly interface where you can input the details of your sales, purchases, and any VAT payable or reclaimable. Submitting VAT returns online is not only convenient but also speeds up the processing time for any refunds you may be entitled to.

Cybooks automaticlly calculates how much VAT you have to pay based on your invoices and expenses. As of October 2024 the TFA portal does not offer an automatic way to submit the VAT return. However: You can copy & paste your numbers from the Cybooks VAT return into the TFA VAT return form.

Who Can Reclaim VAT?

Not all businesses are eligible to reclaim VAT. Here are some criteria that determine eligibility:

- VAT-Registered Businesses: Only businesses registered for VAT can reclaim input VAT on goods and services used for business purposes.

- Taxable Activities: Input VAT can only be reclaimed if it relates to taxable activities. If your business is involved in exempt activities, you will not be able to reclaim VAT on purchases related to those activities.

- Partial Exemption: If your business is involved in both taxable and exempt activities, you may only be able to reclaim a proportion of your input VAT. The exact amount will depend on the percentage of taxable use versus exempt use.

Practical Example

Let's say you're a web development agency in Cyprus. You are registered for VAT and you purchase computer equipment worth €1,000, with VAT of €190. Since the equipment is used entirely for your business, you can reclaim the €190 as input VAT when submitting your quarterly VAT return.

If you also provide VAT-exempt services (such as certain educational workshops), you will need to ensure that any VAT you reclaim is only related to taxable activities, using a partial exemption calculation where necessary.

Important Considerations

- Record Keeping: To reclaim VAT, it is crucial to keep accurate records and retain all VAT invoices for at least six years, as the Tax Department may request these for auditing purposes.

- Reverse Charge Mechanism: For certain cross-border services, VAT may need to be accounted for using the reverse charge mechanism, where the buyer is responsible for accounting for the VAT instead of the seller.

Conclusion

Understanding VAT in Cyprus can feel complicated, but it’s a crucial aspect of running a business effectively. Being familiar with VAT rates, the registration process, and reclaim procedures can help you manage your cash flow and ensure compliance with local tax regulations. If you're ever unsure, it may be beneficial to consult with an accountant or tax advisor who is well-versed in Cypriot VAT rules.

By staying informed and organized, you can make VAT work for you, not against you.