The registration and setup stage, where your Cyprus company becomes a legal entity, is a crucial phase transforms your business plan into reality.

From submitting official documents to obtaining necessary permits, each step brings you closer to launch. While it may seem complex, with the right approach, it's a manageable process. Let's dive in and turn your business vision into a operational company in Cyprus!

1: Submit company registration application to the Department of Registrar of Companies

Submitting your company registration application to the Department of Registrar of Companies is a pivotal step in bringing your Cyprus business to life. This process officially begins your company's legal existence.

To submit your application, you'll need to prepare several documents:

- Application for company name approval HE1 form

- Declaration of compliance HE2 form

- Memorandum and Articles of Association

- Details of directors, secretary, and shareholders

- Registered office address

The application can be submitted online through the Department's electronic filing system, or in person at their office in Nicosia. Online submission is generally faster and more convenient.

The registration fee is based on your company's authorized share capital. As of 2024, it starts at €105 for companies with share capital up to €5,000, increasing for higher capital amounts.

Processing time typically takes 3-5 working days, but can vary depending on the Department's workload and the completeness of your application.

Upon successful registration, you'll receive a Certificate of Incorporation, which includes your official company registration number. This certificate is crucial - it's your company's "birth certificate" and will be needed for various official procedures going forward.

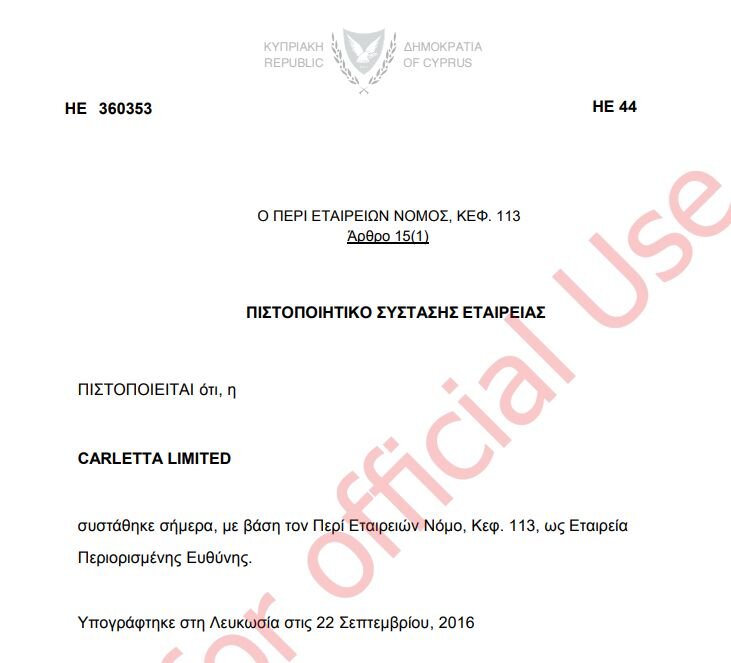

2: Obtain Certificate of Incorporation

The Certificate of Incorporation is your company's official "birth certificate" in Cyprus. It's issued by the Department of Registrar of Companies once your registration application is approved. This document is crucial proof of your company's legal existence and limited liability status.

The certificate typically includes key details such as your company's name, registration number, date of incorporation, and registered address. It's usually issued within a few days after your application is processed and approved.

Once you receive the Certificate of Incorporation, keep it safe. You'll need it for various official procedures, including opening bank accounts, applying for business licenses, and entering into contracts. It's also often required when dealing with potential clients or partners as proof of your company's legal status.

While the original certificate is important, it's a good practice to make several certified copies. These can be used for day-to-day business needs, preserving the original for the most critical situations.

Remember, the Certificate of Incorporation marks the beginning of your company's official journey. From this point on, your company is a distinct legal entity, capable of entering into contracts, owning property, and conducting business in its own name.

3: Register for VAT

Value Added Tax (VAT) registration is a crucial step for many businesses in Cyprus. Whether you need to register depends on your company's activities and turnover.

In Cyprus, VAT registration is mandatory if your annual turnover exceeds €15,600 for goods or €15,600 for services. Even if you're below this threshold, you can voluntarily register if it benefits your business, such as when you expect to make significant purchases and want to reclaim the VAT.

To register, you'll need to submit a TD1001 form to the VAT Service of Cyprus. This can be done online through the TAXISnet system or in person at a VAT office. You'll need to provide details about your business, including your Certificate of Incorporation, business activities, and projected turnover.

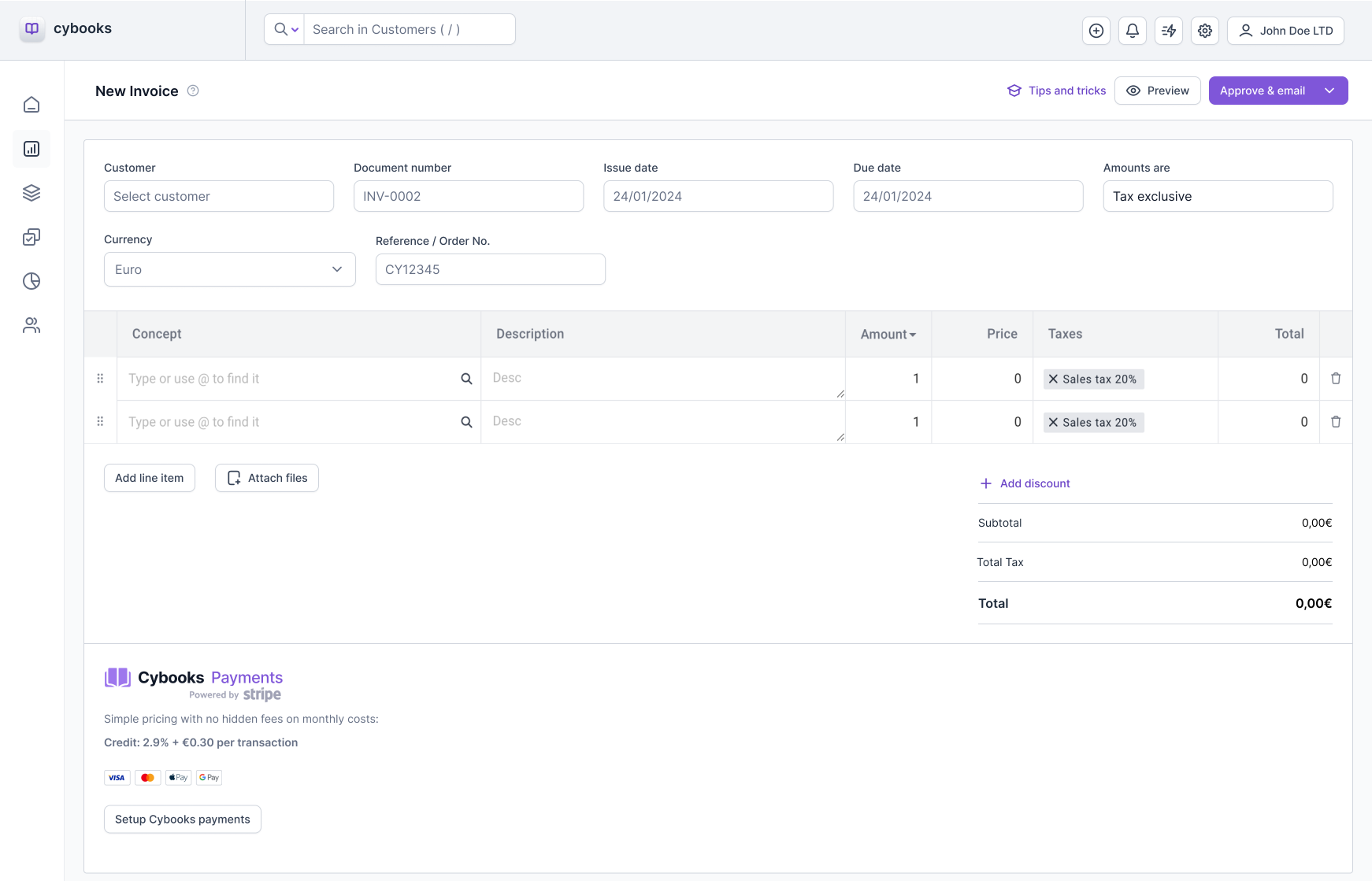

Once registered, you'll receive a VAT identification number. This number must appear on all your invoices and VAT returns. You'll be responsible for charging VAT on your sales (currently 19% for most goods and services in Cyprus), collecting it, and remitting it to the tax authorities.

Cybooks can handle these invoices and even the VAT returns, so you always have an overview about your VAT obligactions.

Remember, VAT registration comes with ongoing obligations. You'll need to file regular VAT returns (usually quarterly) and keep detailed records of your sales and purchases. It's advisable to set up a proper accounting system from the start to manage these requirements effectively.

If you're unsure about your VAT obligations or the registration process, consider consulting with a local tax advisor. They can help ensure you comply with all requirements and potentially identify VAT-related opportunities for your business.

Read our article about the VAT Guide in Cyprus to understand how VAT works and how to submit your VAT return. Especially if you're within the B2B business it can make sense to register for VAT directrly, to be able to reclaim your VAT from the tax department.

4: Register with the Social Insurance Department

Registering with the Social Insurance Department is a mandatory step for all employers in Cyprus. This registration ensures that your company complies with social security obligations and protects the rights of your employees.

To register, you'll need to submit an Employer's Registration form to the Social Insurance Department within one month of hiring your first employee. This form requires details about your company, including your registration number, business activities, and the number of employees you expect to hire.

Once registered, you'll receive an employer's registration number. This number is crucial for all future interactions with the Social Insurance Department, including making contributions and filing returns.

As an employer in Cyprus, you're required to contribute to various social insurance schemes on behalf of your employees. These typically include:

- Social Insurance Fund

- General Healthcare System (GHS)

- Redundancy Fund

- Human Resource Development Fund

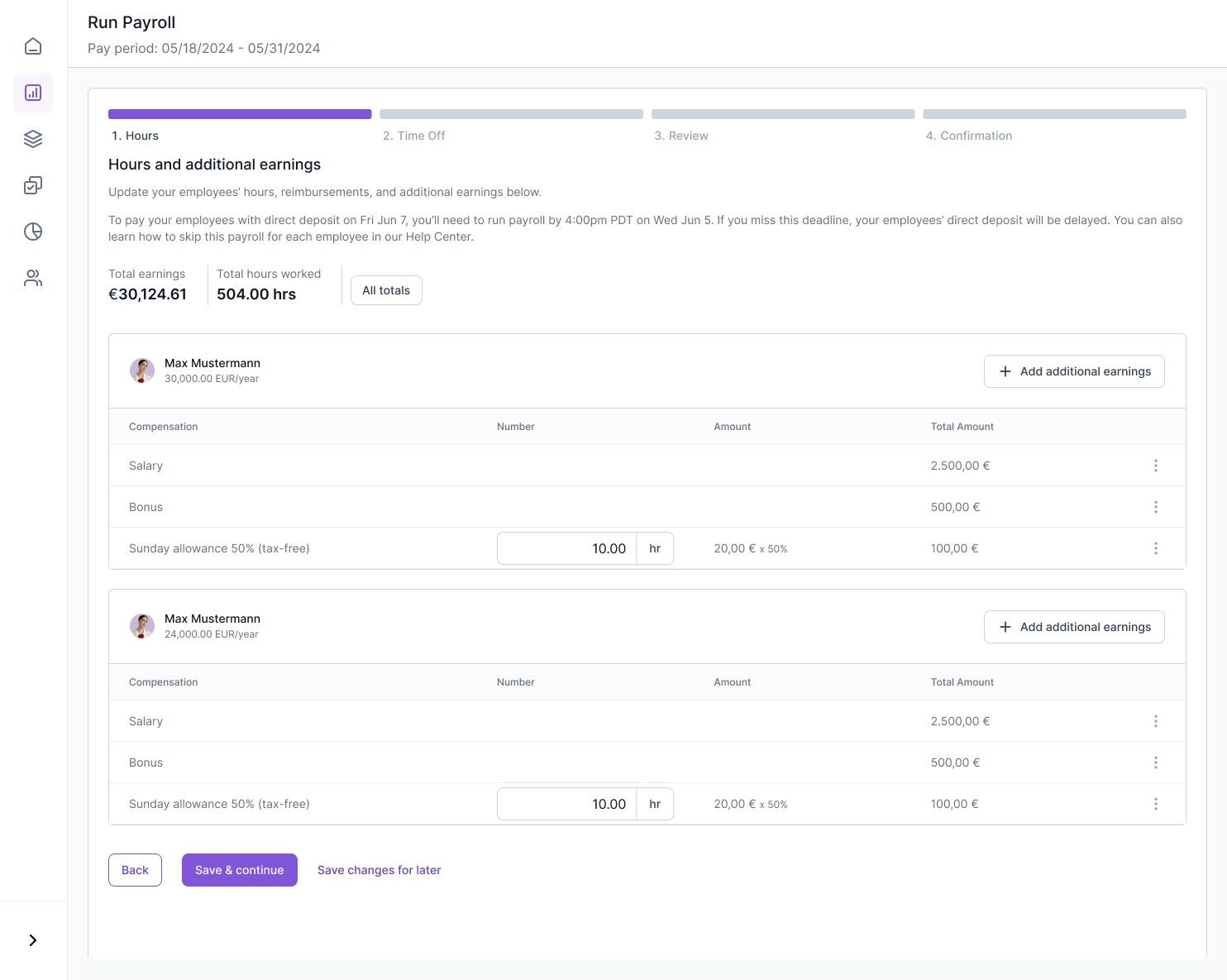

The contribution rates are calculated as a percentage of each employee's gross salary, with both the employer and employee typically making contributions. As of 2024, the total contribution rate is around 20.2% of the employee's gross salary, with the employer's share being approximately 11.8%.

Salary calculator

Use our salary calculator to know how much taxes your have to pay on your salary.

Remember, you'll need to submit monthly statements of earnings and deductions for each employee, along with the corresponding contributions. It's crucial to keep accurate records and make timely payments to avoid penalties.

Given the complexity of social insurance regulations and the importance of compliance, many companies in Cyprus choose to work with a local payroll specialist or accountant to manage these obligations effectively.

Cybooks offers an integrated Payroll system which handles all calcualtions for you.

5: Open a corporate bank account in Cyprus

Opening a corporate bank account is a critical step in setting up your business operations in Cyprus. It's essential for managing your company's finances, receiving payments, and establishing credibility with clients and suppliers.

Cyprus has a well-developed banking sector with both local and international banks offering corporate services. Some popular options include Bank of Cyprus, Hellenic Bank, and RCB Bank, as well as international banks with a presence in Cyprus.

Read our article about the Top 5 banks for a Cyprus company.

To open a corporate account, you'll typically need to provide:

- Certificate of Incorporation

- Memorandum and Articles of Association

- Board resolution authorizing the account opening

- Proof of company's registered address

- Identification documents for all directors, significant shareholders (usually those owning more than 10%), and authorized signatories

- Brief business plan or description of company activities

- Initial source of funds declaration

Many banks in Cyprus now offer the option to start the account opening process online, but you may need to visit a branch in person to complete the process and verify documents.

Be prepared for a thorough due diligence process. Cyprus banks adhere to strict anti-money laundering (AML) regulations, so they'll want to understand your business model and the source of your funds clearly.

The account opening process can take anywhere from a few days to several weeks, depending on the bank and the complexity of your company structure. Some banks may require a minimum deposit to open and maintain the account.

Consider factors like online banking facilities, international transfer fees, and multi-currency account options when choosing a bank. It's often helpful to seek recommendations from your local business advisor or accountant, as they may have insights into which banks are most accommodating to businesses in your industry.

6: Apply for any necessary business licenses or permits

Depending on your business activities, you may need to obtain specific licenses or permits to operate legally in Cyprus. This step is crucial to ensure compliance with local regulations and avoid potential legal issues down the line.

The licenses and permits required can vary widely based on your industry and specific activities. Some common examples include:

- Trade license for retail businesses

- Health and safety permits for food-related businesses

- Environmental permits for certain manufacturing activities

- Professional licenses for regulated professions (e.g., lawyers, accountants)

- Tourism license for hotels and travel agencies

To determine which licenses you need, start by checking with the Cyprus Ministry of Energy, Commerce and Industry. They can provide guidance on general business licenses. For industry-specific permits, you may need to contact relevant government departments or regulatory bodies.

If you run a "normal" company such as software development, E-Commerce or anything else, there's no need for a special license.

7: How to obtain a tax identification code

Obtaining a Tax Identification Code (TIC) is a crucial step for operating your business in Cyprus. The process is done through the 'Tax For All' (TFA) Portal and involves several steps:

Step 1: Create and Verify Your TFA Account

- Go to the Tax For All Portal

- Create an account by providing your personal details

- Verify your account using the link sent to your email (valid for 2 hours)

- After verification, log in and select Register as a new taxpayer, then Register an Individual as a new taxpayer

The TFA portal provides a short guide on how to create an account. Or just watch the video below to see on how to register a new account within the tax for all portal.

Step 2: Complete Registration and Upload Documents

- Answer the relevant questions and provide requested details

- Upload required documents based on your status

- Click Submit Reques to complete the process

Step 3: Receive Your TIC and TAXISnet Codes

A representative from the Cyprus tax office will contact you via email to provide your:

- TIC number

- TAXISnet login codes

Remember, this process is handled by the Cyprus tax authorities, not by any private entity. If you encounter any issues or have questions during the process, it's best to contact the tax office directly for assistance.

Obtaining your TIC is a critical step in setting up your business operations in Cyprus. This number will be essential for various tax-related procedures and interactions with government authorities, so ensure you keep it safe and easily accessible.

8: Hold initial board meeting and shareholder meeting

After incorporation, holding initial board and shareholder meetings is a crucial step in setting up your company's governance structure and operations in Cyprus. These meetings formalize key decisions and establish important company policies.

Board Meeting

The first board meeting typically covers:

- Appointment of officers (e.g., Chairperson, CEO, CFO)

- Approval of the company seal and share certificates

- Adoption of company policies (e.g., financial, operational)

- Approval of banking arrangements

- Discussion of initial business strategy

Shareholder Meeting

The initial shareholder meeting usually addresses:

- Confirmation of share allotments

- Appointment or ratification of directors

- Approval of any pre-incorporation contracts

- Discussion of any major upcoming decisions

While these meetings can be held in person, Cyprus law also allows for virtual meetings, which can be convenient for companies with international shareholders or directors.

It's crucial to keep detailed minutes of these meetings. These minutes serve as official records of company decisions and may be required for various legal and administrative purposes in the future.

Given the legal importance of these initial meetings, many companies in Cyprus choose to have their corporate lawyer present or review the minutes to ensure all necessary points are covered and properly documented.

Remember, these initial meetings set the tone for your company's governance. They're an opportunity to establish clear communication channels and decision-making processes that will serve your business well as it grows.

For companies with a sole director/shareholder, these "meetings" can often be conducted through written resolutions. However, it's still important to document the decisions made.