What Is the One Stop Shop OSS Scheme

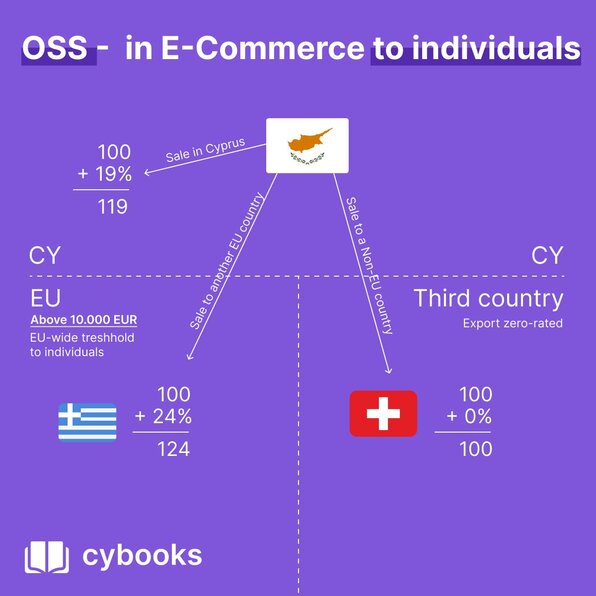

The One Stop Shop (OSS) scheme is changing how businesses handle VAT for B2C transactions in the EU. It's part of the 2021 EU E-Commerce VAT Package, designed to simplify cross-border online trade.

With OSS, you can register for VAT in one EU Member State and report all your EU transactions through a single return. No more managing multiple VAT registrations across different countries. It's a significant improvement.

Key Benefits of OSS:

- Single Registration: Register in one Member State for all EU transactions.

- Simplified Reporting: File one quarterly return instead of multiple.

- Ease of Compliance: Payments are collected and distributed from one place.

This scheme is particularly helpful for small businesses. It reduces bureaucracy and simplifies VAT compliance. Whether you're selling goods or services across EU borders, OSS streamlines your VAT obligations and reduces administrative work.

The OSS allows you to focus on growing your business instead of navigating complex VAT rules. It provides a clear path through the often confusing world of VAT compliance.

Registration Process

Registering: Both EU and non-EU businesses can register for OSS. Non-EU businesses might need to appoint an intermediary based in the EU. This intermediary handles VAT obligations on their behalf, ensuring compliance.

If you have a business in Cyprus, you're able to register at the OSS portal from the Cypriot Tax Department.

Reporting Requirements

Reporting: For Union and Non-Union OSS, you’ll file quarterly returns. The deadline is the last day of the month following the quarter. For IOSS, returns are monthly. Keep detailed records of all transactions for audit purposes. Authorities may request this data to ensure correct VAT application.

Pan-EU Threshold

Threshold: There’s a pan-EU threshold of €10,000. If your cross-border sales exceed this amount, you must use OSS for your VAT reporting. This ensures that VAT is paid correctly across all Member States where your customers are based.

Understanding these mechanics helps streamline your VAT obligations, making it easier to focus on growing your business. For businesses operating in Cyprus, it is also essential to keep track of local VAT obligations. Detailed information on this can be found in our guide on Cyprus VAT Return procedures, which outlines the quarterly submission requirements and deductible VAT expenses.

Benefits and Simplifications of OSS

Using the OSS scheme brings a ton of benefits to your business. First off, it simplifies VAT compliance. Instead of juggling multiple VAT registrations across different EU countries, you can register in just one Member State. This means fewer headaches and more time to focus on your core business.

Filing a single OSS return for all your EU transactions is a game-changer. For Union and Non-Union OSS, you only need to submit a quarterly return. If you’re using the IOSS, returns are monthly. This streamlined process cuts down on paperwork and makes compliance a breeze.

- Single Registration: No need to register for VAT in multiple countries.

- Quarterly Returns: Simplified for Union and Non-Union OSS.

- Monthly Returns: For IOSS, keeping things straightforward.

Avoiding penalties is crucial. Non-compliance can lead to hefty fines, expulsion from the scheme, and the hassle of re-registering for VAT in multiple Member States. Stick to the OSS requirements to keep these issues at bay. For example, the Cyprus Tax Calendar outlines essential monthly compliance deadlines and the penalties for late tax submissions, helping you stay on top of your obligations.

- Penalties: Fines, expulsion, and multiple VAT registrations.

- Compliance: Adhering to OSS requirements is essential.

The OSS scheme is especially handy for small businesses. It reduces administrative burdens and saves costs, letting you concentrate on growing your business. No more navigating complex VAT rules—OSS makes your life simpler.

By understanding and leveraging the benefits of the OSS, you can streamline your VAT obligations and free up resources to drive your business forward.

Key Takeaways From the OSS Scheme

The OSS scheme simplifies VAT compliance for businesses trading across the EU. It's a real time-saver, letting you register in one Member State and report all your EU transactions through a single return.

Here are the main benefits:

- Single Registration: No need to register for VAT in multiple countries.

- Simplified Reporting: File one return for all EU transactions.

- Ease of Compliance: Payments are collected and distributed from one place.

Understanding the different parts of the OSS—Import OSS, Union OSS, and Non-Union OSS—is crucial. Each serves a distinct purpose, helping you manage VAT for various types of transactions.

- Import OSS (IOSS): For low-value goods from outside the EU.

- Union OSS: For B2C goods and services within the EU.

- Non-Union OSS: For non-EU businesses providing services to EU consumers.

Knowing the reporting requirements is vital. Union and Non-Union OSS require quarterly returns, while IOSS needs monthly returns. Keep detailed records of all transactions to avoid any issues during audits.

Non-compliance can lead to significant penalties, including fines and expulsion from the scheme. Adhering to OSS rules is essential to avoid these extra costs and complications.

By leveraging the OSS scheme, you can reduce administrative burdens and focus on growing your business. Simplify your VAT obligations and enjoy more streamlined operations.