1. Checking Company Name Availability

Once you have some potential names in mind, the next step is to verify their availability. Here’s how to check:

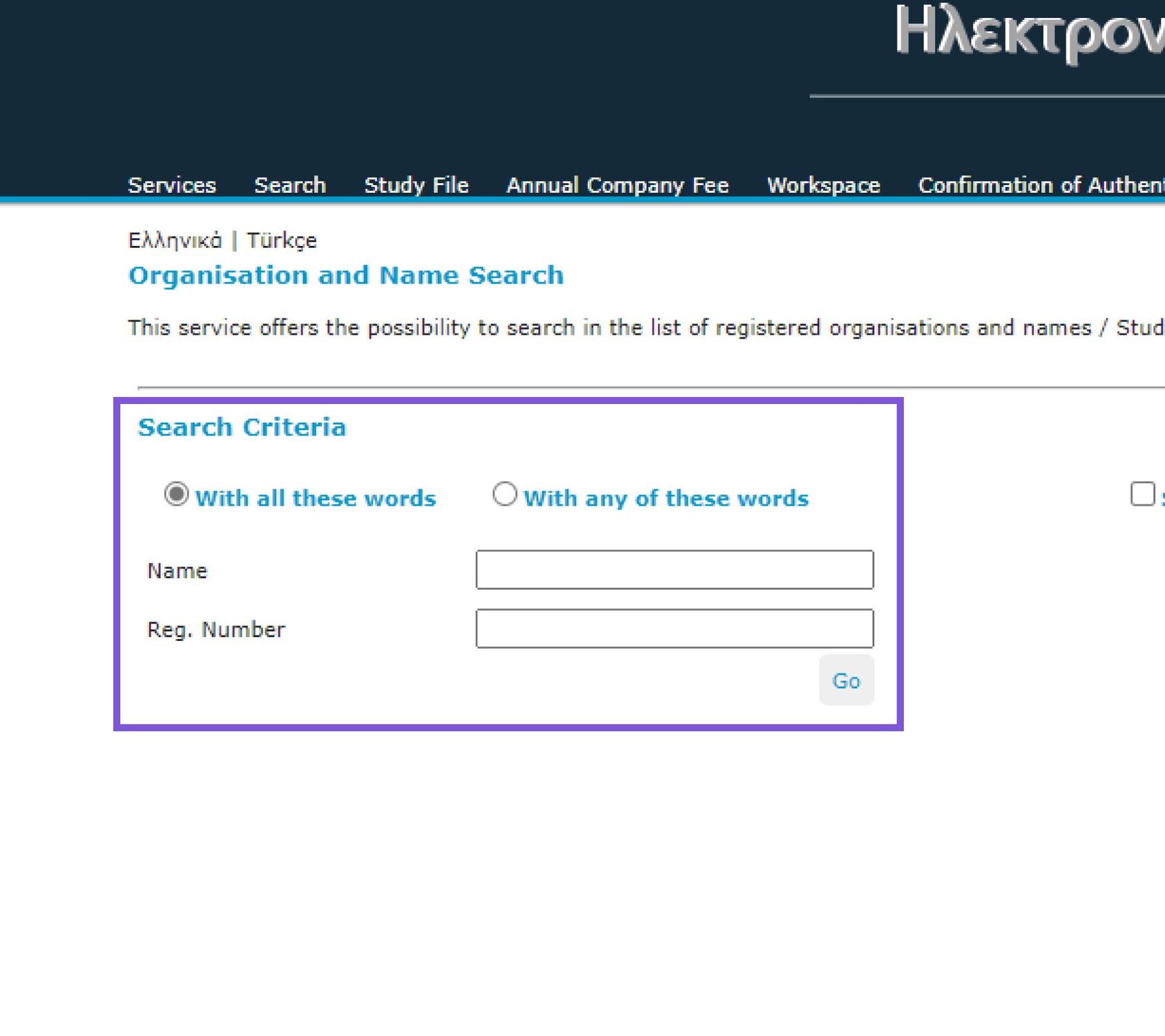

- Online Name Search: Visit the Department of Registrar of Companies e-filing portal to perform a preliminary search for the name’s availability. This will give you an idea of whether your chosen name is unique.

- Formal Name Reservation: You can submit an official request for name approval through the same portal. This will reserve the name while you proceed with the next steps of registration. The reservation process typically takes a few days.

- Consult a Local Expert: To avoid any naming pitfalls, it’s helpful to work with a local legal advisor or company formation specialist who is familiar with Cypriot regulations and can guide you through the process.

Cybooks's Company Search

Search faster for existing companies in Cyprus

Searching within the company register

Knowing how to navigate this register can save you time and help you avoid potential setbacks. Simply enter the desired name in the search field to see if it’s already in use. This straightforward process is crucial for ensuring your business name stands out and complies with local regulations.

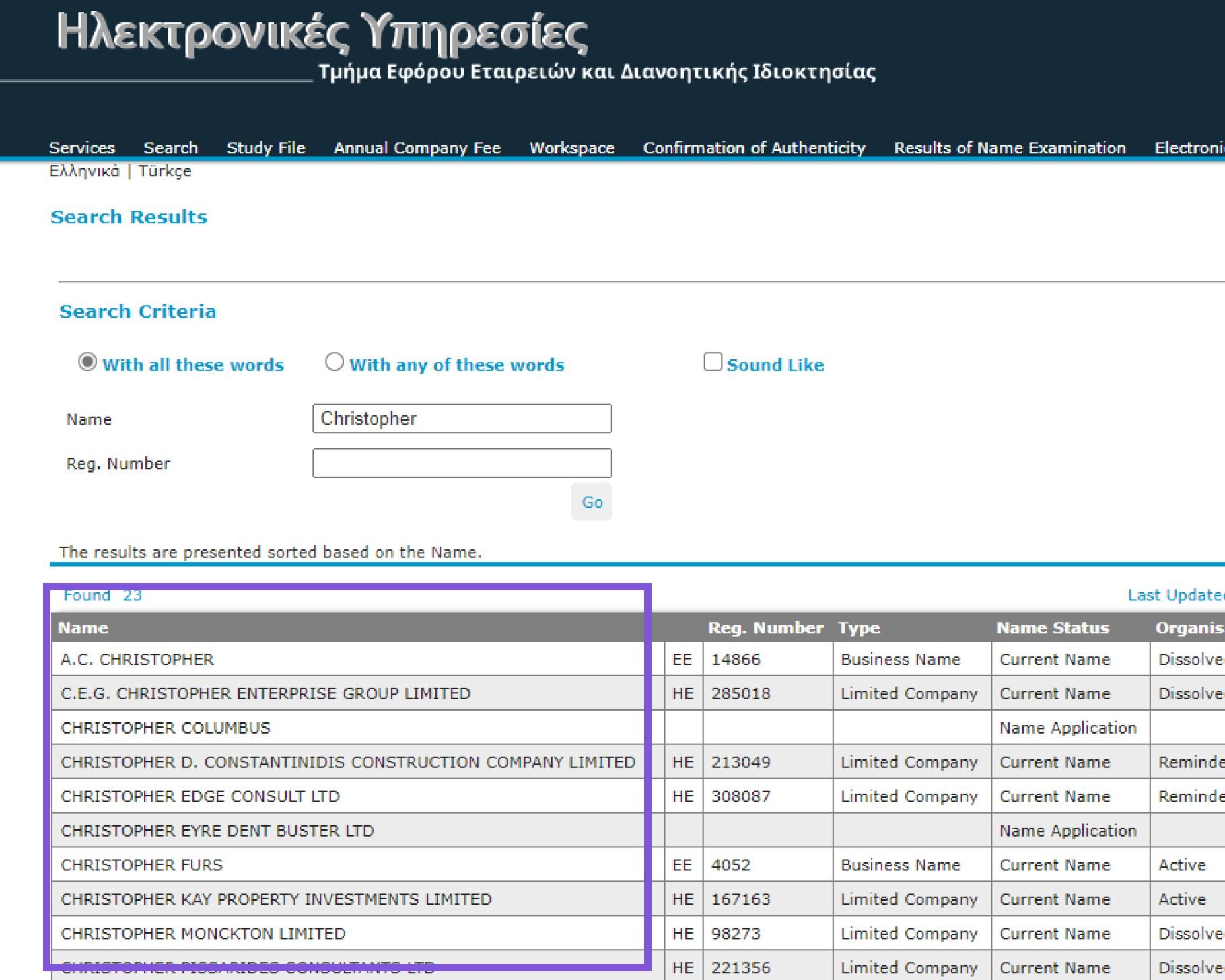

Company name results

When submitting a company name to the registar, you need to list three possible names. So even if one company name might be taken, they will choose from the other two remaining names.

2 Decide on the company's registered address in Cyprus

Choosing your company's registered address in Cyprus is more than just a formality - it's a strategic decision that can impact your business operations. This address will be used for official correspondence and must be a physical location in Cyprus, not just a P.O. box.

Consider factors such as accessibility for clients and employees, proximity to relevant business hubs or government offices, and cost. Popular locations include Nicosia, the capital, and Limassol, known for its business-friendly environment.

If you're not ready to commit to a physical office, many business centers in Cyprus offer virtual office services, providing a prestigious address and mail handling. However, ensure this complies with local regulations for your specific type of business.

Remember, changing your registered address later involves paperwork and fees, so choose wisely from the start. Consulting with a local real estate agent or business advisor can help you find the best location that balances your budget with your business needs.

A lot of accountants in Cyprus are offering such a virual office address as part of their service. The costs are normally around 300 EUR per year for a virtual office address.

You can check our list of accountants that we recommended.

3 Determine the company's share capital and structure

Deciding on your company's share capital and structure in Cyprus is crucial for your business's financial foundation and ownership setup. There’s no minimum share capital for private limited companies, but it's smart to align the amount with your initial funding needs and growth plans. Your share capital can be in euros or another currency.

You also need to decide on the type and number of shares. Common shares are standard, but different share classes can offer flexibility if you plan to attract various investors or need specific control measures. Note that Cyprus allows single shareholders, who can be individuals or corporations.

Changing your share capital or structure later is possible but involves legal and tax implications. Consulting a local financial advisor or company formation specialist is advisable to ensure your setup aligns with your business goals and complies with Cyprus regulations.

If you're just starting a small company, a share capital of 1.000 EUR in total and 1000 shares is pretty common.

So at the end you have:

1000 shares * 1 EUR = 1.000 EUR share capital.

4 Appoint directors and company secretary

Appointing directors and a company secretary is a key step in establishing your company's management structure in Cyprus. By law, your company must have at least one director, but you can appoint more based on your business needs.

Here's a quick list of the required members for a Cyprus company:

- Director(s): At least one, no maximum limit

- Company Secretary: One required

- Shareholder(s): At least one, can be the same person as the director

Director

Directors are responsible for managing the company's affairs and making key business decisions. They can be of any nationality and don't need to be residents of Cyprus. However, having a local director can be advantageous for understanding the Cyprus business environment and managing day-to-day operations.

Secratary

The company secretary's role includes maintaining company records, filing necessary reports, and ensuring compliance with legal requirements. While the company secretary doesn't need specific qualifications, they should be familiar with Cyprus corporate law.

It's worth noting that in a single-member company, one person can hold both the director and company secretary positions. For larger companies, it's common to have multiple directors and a dedicated company secretary.

5 Identify shareholders and determine shareholding structure

Identifying shareholders and determining your company's shareholding structure is a critical step in setting up your business in Cyprus. This decision will shape your company's ownership, control, and potentially its operational dynamics.

In Cyprus, a private limited company can have a minimum of one and a maximum of 50 shareholders. These can be individuals or corporate entities, and they don't need to be Cyprus residents or nationals. This flexibility allows for various ownership structures to suit different business needs.

When determining your shareholding structure, consider the following key points:

- Ownership distribution: Decide how the company's ownership will be divided among shareholders. This could be equal distribution or varying percentages based on investment or other agreements.

- Types of shares: Cyprus allows for different classes of shares with varying rights. Common shares typically carry voting rights and dividend entitlements, while preference shares might offer priority in dividend payments but limited voting rights.

- Future considerations: Think about potential future needs. Will you want to bring in new investors? Are you planning for an eventual public listing? Your initial structure should be flexible enough to accommodate future changes.

- Legal and tax implications: Different shareholding structures can have varying legal and tax consequences. For instance, having a local shareholder might affect your company's tax residency status.

It's crucial to document your shareholding structure clearly in your company's memorandum and articles of association. This includes detailing the rights and obligations attached to different share classes if applicable.

6 Prepare Memorandum and Articles of Association

Preparing the Memorandum and Articles of Association is a crucial step in setting up your company in Cyprus. These documents form the constitution of your company, defining its purpose, structure, and operational rules.

The Memorandum of Association outlines the company's relationship with the outside world. It typically includes:

- The company's name

- Its registered office address

- The company's objectives or purpose

- A statement of limited liability

- Details of the company's share capital

- The Articles of Association, on the other hand, govern the company's internal affairs. They typically cover:

- Rights and responsibilities of shareholders - Procedures for board meetings and shareholder meetings - Rules for appointing and removing directors - Dividend distribution policies - Share transfer procedures

While Cyprus law allows for significant flexibility in drafting these documents, they must comply with the Cyprus Companies Law. Many companies start with standard templates and customize them to their specific needs.

It's important to draft these documents carefully, as they will guide your company's operations and can be challenging to change later. Consider future scenarios such as bringing in new investors, changing your business model, or planning for succession.

Given the legal complexities and long-term implications, it's highly recommended to seek assistance from a local corporate lawyer when preparing your Memorandum and Articles of Association. They can ensure your documents are compliant with Cyprus law, protect your interests, and provide the flexibility your business needs to grow.

Remember, these documents will need to be submitted to the Registrar of Companies as part of your company registration process. Once approved and registered, they become public documents, accessible to anyone who wishes to view them.

You can use our free Memorandum and Articles of Association template.

Many lawyers and accountants already have such a standard template in place in case you need one.