Filing or submitting a VAT return in Cyprus is a straight forward and easy process, as long as you have all required amounts ready.

Thanks to the new Tax For All Portal from the Cyprus Government, you can file your VAT return in minutes by yourself.

VAT Return Periods

In Cyprus, businesses file VAT returns quarterly, covering three-month periods. The standard deadline is the 10th of the second month after the quarter ends. However, extensions may apply in special cases, such as system updates or administrative changes. Always check for announcements to stay compliant and avoid penalties.

| VAT Period | Deadline |

|---|---|

| Sep - November | 10 Jan 2025 |

| Jun - August | 10 Oct 2024 |

| Mar - May | 10 Jul 2024 |

| Dec - February | 10 Apr 2024 |

How to file a VAT Return

Following we show you 10 simple steps on how to submit the VAT return in Cyprus in 2024 within the new Tax For All portal.

In this quick 4-minute video, we walk you through the steps on how to submit a VAT return within the new TFA ( Tax For All Portal), if you prefer reading, just go to our Steps to file a VAT return.

Steps to file a VAT return

- Register for an Tax For All account if you don't have one yet

- Login into the Tax For All portal

- Have all your VAT amounts ready

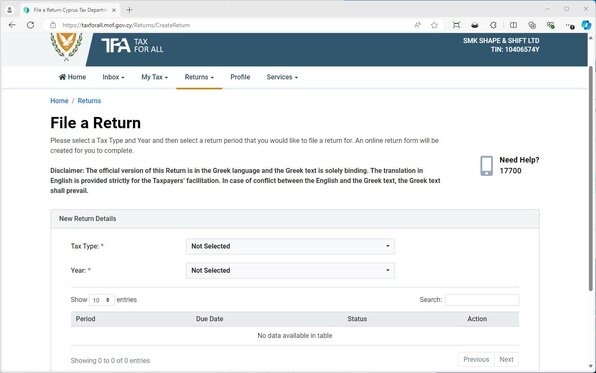

- Go to Returns -> File a return

- Select your Tax Type & Year

- Select your VAT period

- Start a VAT return

- Input your amounts within the required boxes

- Upload documents as proof if necessary

- Review & submit the VAT return

Cybooks automaticlly calculates all required amounts you need for the VAT return in Cyprus.

Filing a VAT return is as simple as copy & pasting.

Step 1: Register for an Tax For All account

The first step is to register for a new account at the Tax For All portal. If you already have one, proceed with step 2.

Step 2: Login into the Tax for All portal

If you have your Tax For All account, just login into the Tax For All portal.

Step 3: Have your VAT amounts ready

You need to enter all amounts for the different boxes within the VAT return, so have them ready.

Step 4: Go to Returns -> File a return

Within the File a return overview, you have an overview about all your returns that needs to be submitted.

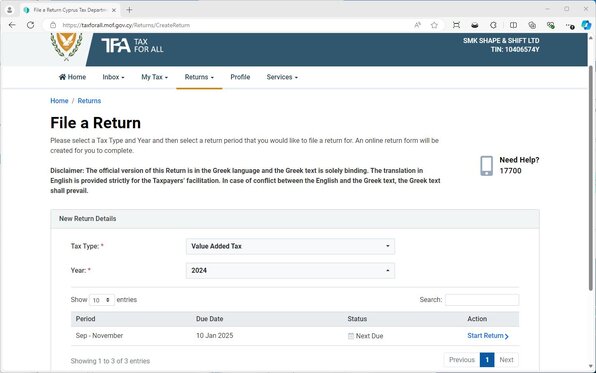

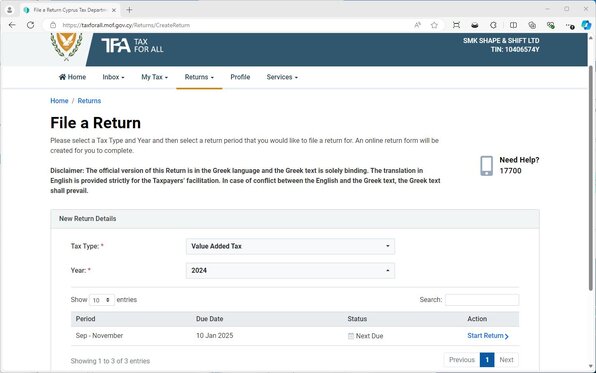

Step 5: Select your Tax Type & Year

To actually see which VAT returns you have to submit, you first need to select the Tax Type and Year. The Tax Type for the VAT return is called Value Added Tax.

Step 6: Select your VAT period

Choose your VAT period and click Start Return. Depending if you have open drafts or when a VAT return is overdue, these will also be shown within the overview.

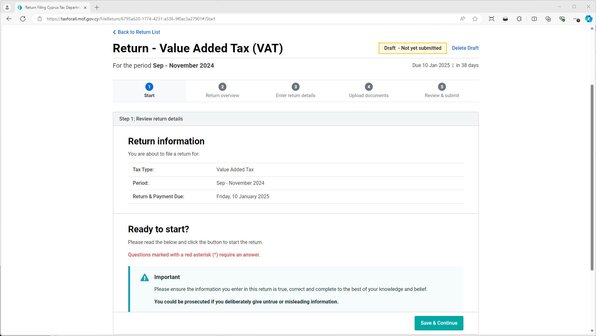

Step 7: Start a VAT return

The VAT return has 5 simple steps. If you're ready to start, just click the Save & Continue button at the bottom to start the VAT return and repeat the same action for the second step.

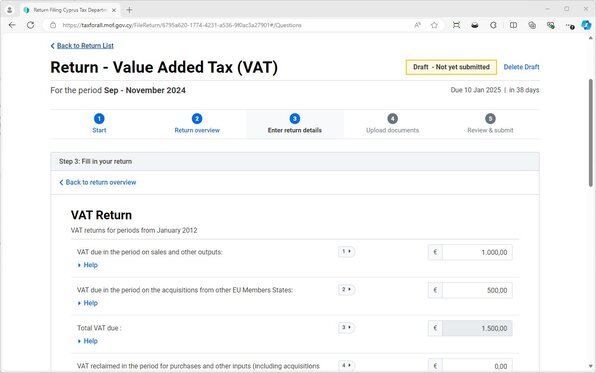

Step 8: Enter your return details

This is the most important step. Inside the Enter return details step, you need to enter all your calculated amounts for the different boxes for the VAT return.

In our VAT Guide, we've explained all different boxes.

Note that box 3 ( Total VAT due ) and Box 5 ( Net VAT to be paid or reclaimed ) is automaticlly calculated based on the amounts you input into the other boxes.

After you have entered all your amounts, simply click the Save & Continue button at the bottom of the page.

Remember that Cybooks will calculate all these numbers for you. When using Cybooks, it's as easy as copy & pasting the amounts to submit the VAT return.

Step 9: Upload documents

If you have any documents to upload, upload the documents. Normally this is not required, however: Keep in mind that you need to have all your documents as proof for the tax authorities.

This is especially important, if you want to reclaim VAT from the tax departmern: You need to have copies of your expense receipts and invoices, when you want to reclaim VAT.

Step 10: Review & submit

Carefully review all data you've entered. As the portal already tells:

Please ensure the information you enter in this return is true, correct and complete to the best of your knowledge and belief. You could be prosecuted if you deliberately give untrue or misleading information.